At its regular meeting on Monday, November 24, 2025, the Enumclaw School District Board of Directors approved Resolutions 1150 and 1151 to place two replacement levies before voters in the Special Election scheduled for February 10, 2026.

If approved, the Educational Programs and Operations (EP&O) Replacement Levy and the Instructional Technology Replacement Levy would continue funding for existing programs and services when the current voter-approved levies expire in 2026. The EP&O levy was last approved in 2022, and the Instructional Technology levy in 2020.

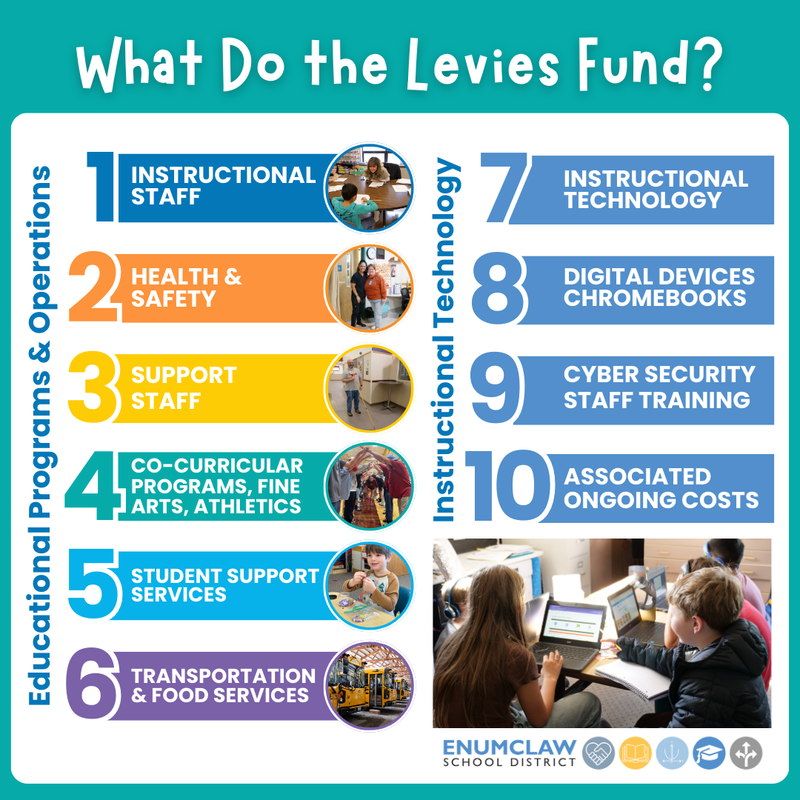

Continuing Support for Programs and Services

Local levies help close the gap between state and federal funding and the actual cost of operating schools in Enumclaw. Together, the district’s current voter-approved levies account for about 16 percent of the district’s operating budget.

Educational Programs and Operations Replacement Levy (Resolution 1150)

The proposed four-year EP&O Replacement Levy would maintain funding for:

Health and safety services, including counselors, nurses and health room staff, safety and security, and social and mental health supports

Instructional and support positions such as custodians, librarians, paraeducators, and certificated staff

Student support and early learning services

Educational programs and classroom supplies, transportation, child nutrition, music and arts, athletics, and co-curricular activities

Maintenance and operations of playgrounds, playfields, and other facilities

For tax years 2027 through 2030, the EP&O levy is projected to collect between approximately $15.4 million and $18.3 million per year, with an estimated levy rate of $1.74 per $1,000 of assessed property value each year.

Instructional Technology Replacement Levy (Resolution 1151)

The proposed six-year Instructional Technology Replacement Levy would maintain funding for:

Maintaining and improving classroom technology and district technology infrastructure

Replacement and upgrades of computers, devices, hardware, software, and telecommunications systems

Cybersecurity

Staff training and support for instructional technology

Associated staffing, equipment, furniture, subscriptions, licenses, and ongoing fees

For tax years 2027 through 2032, the Technology Levy is projected to collect between approximately $2.47 million and $3.30 million per year, with an estimated levy rate of $0.28 per $1,000 of assessed property value.

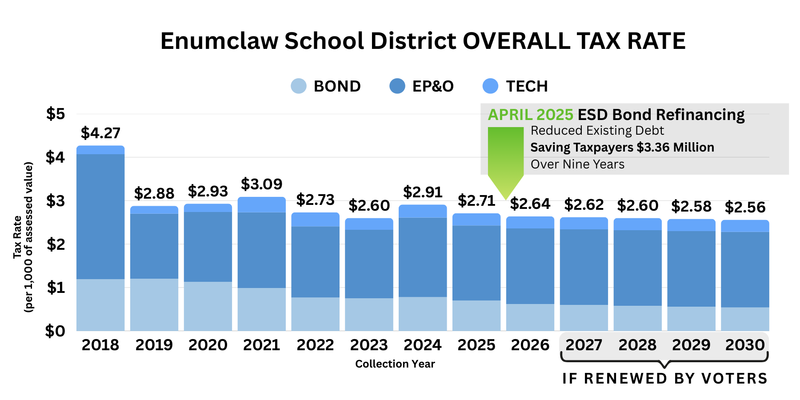

Overall tax rate impact

The district’s overall school tax rate includes the remaining 2015 bond, the current EP&O levy, and the current Technology levy. Even with the renewal of both replacement levies, the total school tax rate is projected to decrease over the next four years as the assessed property values in the district grow.

This decrease is also due to the April 2025 bond refinance. ESD refinanced the District’s outstanding 2015 Bonds. This successful refinancing reduced the District’s existing debt and will save taxpayers $3.36 million over the next nine years.

Learn more

Additional information about the 2026 Replacement Levies are available on the district website at:

https://www.enumclaw.wednet.edu/page/2026-replacement-levies

Community members are encouraged to review the information, ask questions, and stay informed ahead of the February 10, 2026, Special Election.